PLANNING FOR YOUR FUTURE

The foundation of a solid financial plan must be well-grounded and built carefully from the bottom up. By using the financial planning process, you and your planner will work together closely to build a plan by engaging in six stages of development. These stages, created by the Certified Financial Planner Board of Standards, Inc. are strictly adhered to by Public Retirement Planners and are detailed below. Along with compensation, we will discuss how long the professional relationship will last.

Understand your personal and financial circumstances.

Understand your personal and financial circumstances.

A crucial part of any financial plan is for the CERTIFIED FINANCIAL PLANNER™ professional to understand everything about your finances, family, goals, etc. That’s why Step 1 is so important; it’s the basis upon which your planner’s recommendation are made.

Identify your goals and expectations.

Identify your goals and expectations.

You and your CFP® professional will talk about your current financial situation and gather all necessary documents. Together, we will define your personal and financial goals, along with your comfort level when it comes to taking risks with capital.

Analyze your course of action and evaluate the status.

Analyze your course of action and evaluate the status.

Your CERTIFIED FINANCIAL PLANNER™ professional will consider all aspects of your situation to determine how to meet your goals. Depending on the services selected, your planner may analyze your assets, liabilities and cash flow, current insurance coverage, investments, estate plan or tax strategies.

Developing the financial planning recommendations.

Developing the financial planning recommendations.

After identifying your goals and expectations, along with analyzing your course of action, your CFP® professional will develop a number of recommendations that are in your best interest.

Reviewing the financial planning recommendations.

Reviewing the financial planning recommendations.

Your CFP® professional will go over his recommendations, explaining the rationale so that you can make informed decisions. At this stage, your planner will also listen to any concerns you may have and revise his recommendations, if necessary.

Implementing the financial planning recommendations.

Implementing the financial planning recommendations.

You and your financial planner will need to agree on how the recommendations will be carried out. Your CERTIFIED FINANCIAL PLANNER™ professional may carry out the recommendations himself or serve as your coach, coordinating the process with you and other professionals.

Monitoring progress and update as needed.

Monitoring progress and update as needed.

As you work toward your goals, you and your CERTIFIED FINANCIAL PLANNER™ professional will decide who will monitor your progress to make sure you are staying on track. If the planner is in charge, he will check in from time to time, reviewing your situation and making any necessary adjustments to his recommendations.

TYING IT ALL TOGETHER.

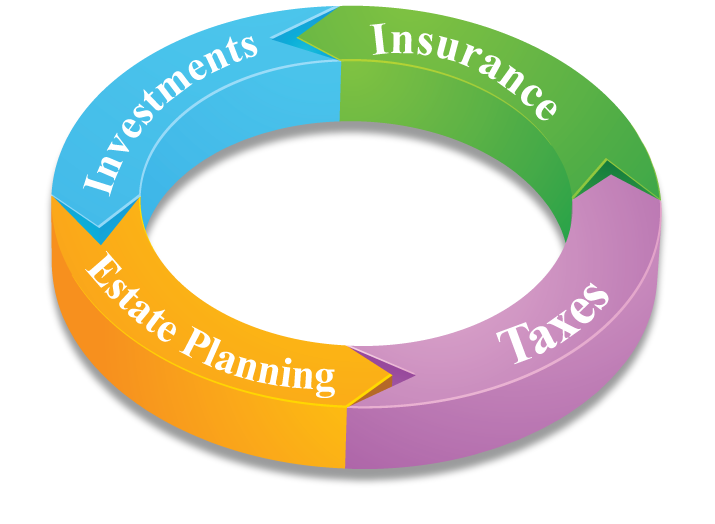

Proper financial planning doesn’t just involve your investments; it takes into account your entire financial picture. That means comprehensive financial planning takes into account everything from your investments, insurance, estate plan and taxes. A knowledgeable Certified Financial Planner™ practitioner has the background and experience to know that advising in one area, such as investments, means another area of finances, such as income taxes, can be impacted.